On May 10, just a day before Bitcoin’s halving, the number of long positions liquidated on BitMEX rose to $295 million.

In total, BitMEX saw over $295 million worth of liquidations on May 10, 2020, with longs accounting for over 96% of 24-hour XBTUSD liquidations

Bitcoin price plunged around 15% on Saturday and triggered liquidations on the BitMEX exchange, which saw over $260 million in long positions liquidated

Although these liquidations hit both long and short positions, it is the longs that bore the brunt. According to the data site Cryptometer, 96% of these liquidations were of XBT/USD longs, worth over $266 million. In contrast, liquidated shorts in BitMEX’s XBT/USD pair were only worth $11.3 million, or just 4%.

Yesterday also saw XRP liquidations on BitMEX reach $12.3 million while Ethereum (ETH) saw $6.5 million. The margin calls represented 4.1% and 2.2% respectively of long positions liquidations in BitMEX contracts. For shorts, XRP and ETH accounted for a paltry 0.02% and 0.22% respectively in liquidated positions.

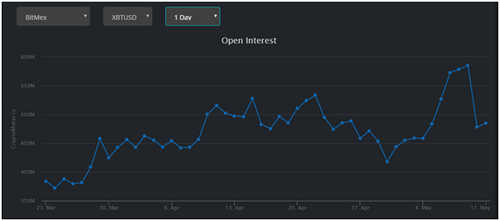

Total liquidations over the past 24 hours stand at $90 million, with longs accounting for over $63 million or 70% and shorts $26 million or 30%. Open interest in BitMEX’s XBT/USD is at $484 million, with current liquidations at close to $1 million (99%) for longs and $10.3k (1%) for shorts.

The XBT/USD perpetual contract is funded and paid out every 8 hours, with investors set to get their next payout at 3:00 PM UTC+3.

BTC below $10,000 sees longs post huge losses

BTC’s plunge to prices close to $8,100 triggered massive activity on BitMEX from longs, just 24 hours to the halving.

Bitcoin price, which touched $10,000 on May 8, clipped the gains with a near 15% drop that took its price from around $9,800 to lows of $8,100. The crash occurred within a quarter of an hour of massive sell-off pressure.

The cryptocurrency’s spot prices fell as bulls failed to hold successive support levels.

BTC has turned positive in the past 24 hours, with intraday gains currently flipping on both sides of $8,700. But what these prices mean is that retail investors, who went long in the hope that the pioneer crypto could surge past $10k, posted losses of up to 15%.

The liquidations are likely from longs eager to cash in on anticipated upsides in the top cryptocurrency’s value on pre-halving hype. But despite touching $10,000 and flashing bullish in the last several weeks, bulls failed to retake the $10k levels. Instead, despite halving hype hitting the ceiling, Bitcoin reversed to leave sentiment largely shaken.

Yet, for enthusiasts, Bitcoin’s price has already taken in a 150% upside since it crashed to a low of $3,800 on March 12.